{"dots":"false","arrows":"false","autoplay":"true","autoplay_interval":3000,"speed":600,"loop":"true","design":"design-1"}

{"dots":"false","arrows":"false","autoplay":"true","autoplay_interval":3000,"speed":600,"loop":"true","design":"design-1"}

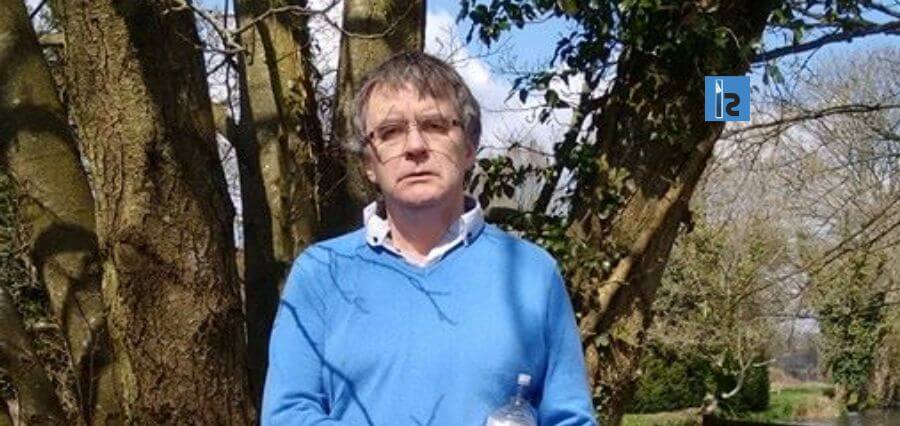

A Trailblazer’s Odyssey: Expertise of Dr. Haibin Zhu in Computer Science and Robotics

Dr. Haibin Zhu, Vice President – Systems Science and Engineering, IEEE SMC Society and Professor, Nipissing University, Canada, is a trailblazer in the field of computer science and robotics. His academic journey began with a

SIGN UP FOR THE INSIGHTS DAILY NEWSLETTER

Our biggest stories, delivered to your inbox every day.